HARARE – The Tigere Property Fund has reported a robust performance for the year, underpinned by strong trading at its newly developed Greenfields complex and continued expansion of its property portfolio.

In an update quoted by NewZwire, Tigere said the Greenfields complex is “performing above fund expectations,” with several key tenants recording stronger-than-anticipated revenues. Major brands operating at the complex, including Smokehouse, Hungry Lion, RocoMamas, Spar, Liquor Supplies and Rollers, are all reported to be outperforming initial projections.

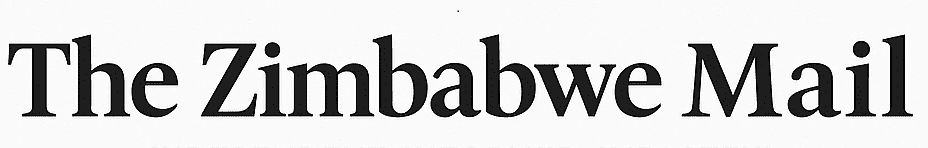

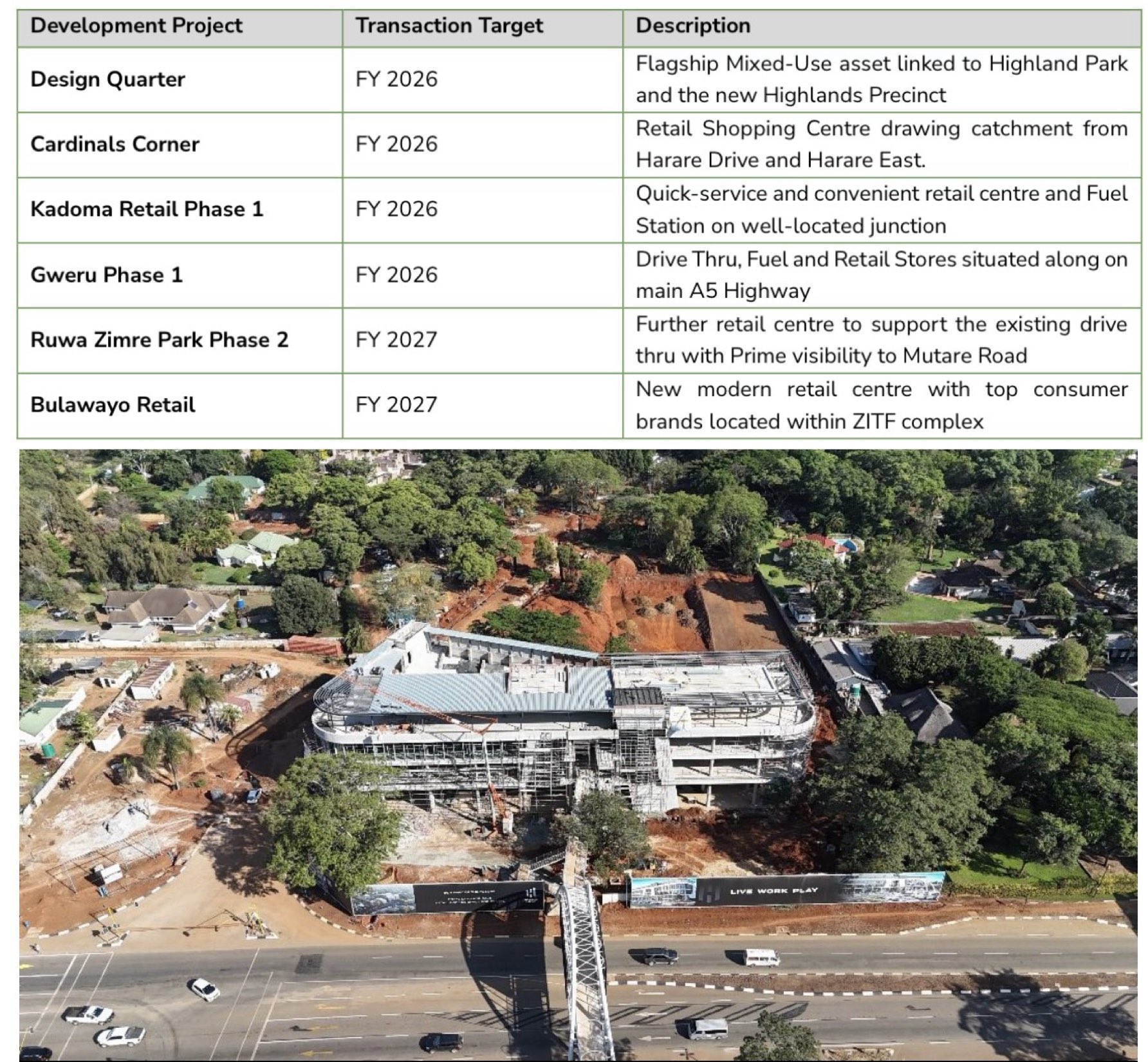

The solid operational performance has been complemented by portfolio growth. Following the addition of the Greenfields development and the Zimre Park Drive-Thru to its asset base this year, Tigere’s total capitalisation has now reached US$101 million, reinforcing its position as one of the country’s fast-growing property investment vehicles.

Looking ahead, the fund has guided that distributable earnings for 2025 – the income paid out to investors – are expected to exceed US$2.3 million. This translates to distributions of between US¢0.1900 and US¢0.1980 per unit, representing a 17% to 22% increase compared to the previous year.

Tigere has also outlined an ambitious medium-term payout target. According to NewZwire, the fund aims to distribute a minimum of US$1 million per quarter to investors from 2026, signalling confidence in the sustainability of its cash flows and rental income.

Beyond local developments, Tigere is also exploring a pipeline of regional assets as part of a broader diversification strategy. The move is intended to provide investors with increased foreign currency exposure and geographic diversification, reducing concentration risk while enhancing long-term returns.

The fund is expected to announce further details on upcoming projects as it continues to expand its footprint and capitalise on demand for well-located, tenant-led retail and mixed-use developments.