HARARE – A leaked confidential report from the Zimbabwe Reserve Bank’s Financial Intelligence Unit (FIU) has revealed that businessman Wicknell Chivhayo sought approval to withdraw up to US $20 million in cash every month through Ecobank, claiming the money was needed to pay Chinese suppliers for a government ICT contract.

The FIU memorandum, dated 13 December 2024, shows that Ecobank had approached the regulator to authorise the extraordinary withdrawals on behalf of three companies owned by Chivhayo.

According to the document seen by The Zimbabwe Mail, “the Financial Intelligence Unit (FIU) received applications from Ecobank for authority to make monthly cash withdrawals of USD 20 million … all owned by Mr. Wicknell Chivhayo.”

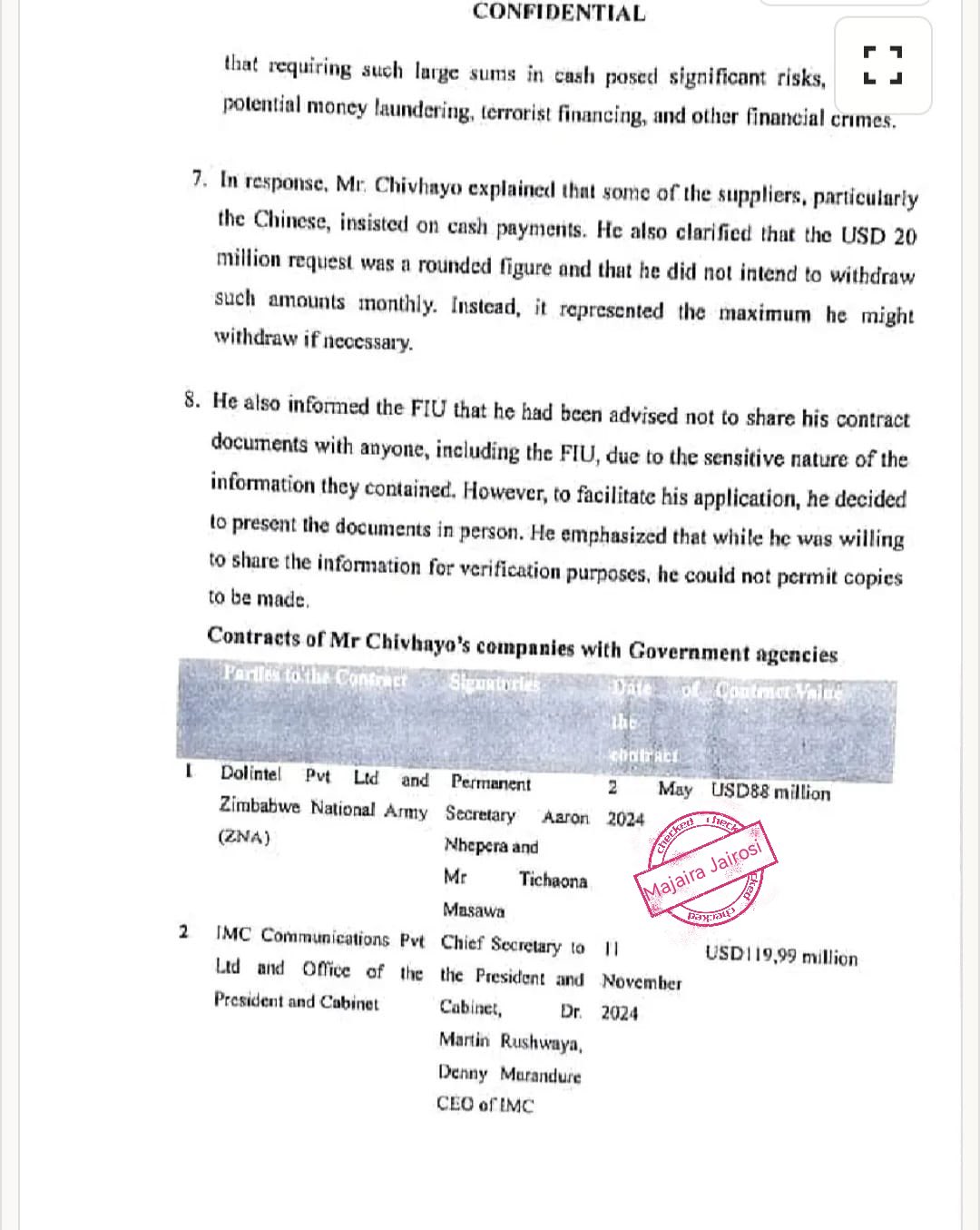

When asked to provide supply contracts to verify the source of funds, Chivhayo flatly refused, arguing that the agreements were confidential. Instead, he requested a private meeting so he could present the paperwork in person.

At a session held on 13 December with FIU officials and Ecobank representatives, he insisted that some Chinese suppliers demanded cash and that the US $20 million request merely represented the maximum he might ever need to withdraw rather than an amount he intended to take each month.

The document also records FIU concerns that such vast cash movements posed “significant risks of potential money laundering, terrorist financing, and other financial crimes.” Chivhayo maintained that he could not permit copies of the contracts to be made, though he was willing to allow regulators to view them during a face-to-face meeting.

For pro-democracy critics, the revelation underscores the opacity and privilege that characterise Zimbabwe’s political economy. The leaked memo points to multimillion-dollar state contracts linked to Chivhayo’s firms and highlights how politically connected businessmen continue to leverage government deals for personal gain.

As one opposition-aligned economist put it, this episode offers “yet another reminder that public contracts are treated as private piggy banks for those close to power,” deepening public mistrust of a system already strained by corruption and economic hardship.