HARARE – Economic analysts and banking sector professionals have cautiously welcomed the Reserve Bank of Zimbabwe’s (RBZ) 2026–2030 Strategic Plan, describing it as a more coherent and transparent framework that could underpin currency stability and rebuild market confidence if implemented consistently.

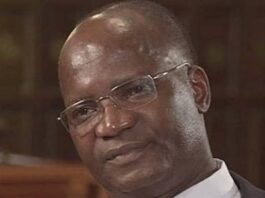

According to The Sunday Mail, the five-year strategy, unveiled by RBZ Governor Dr John Mushayavanhu, places price, currency and exchange-rate stability at the core of monetary policy, while outlining clear preconditions for a gradual transition towards a mono-currency system by 2030. The plan signals a shift towards a more market-oriented approach, with policy credibility identified as a non-negotiable pillar.

In the Executive Summary of the strategy, Dr Mushayavanhu said the central bank would “stay the course” on stability-focused reforms, emphasising that sustained low inflation, adequate foreign reserves, a sound financial system and close coordination between fiscal and monetary authorities were essential foundations for long-term success.

“The Reserve Bank will work on the timely achievement of the conditions precedent for a smooth transition to mono-currency,” Dr Mushayavanhu said, stressing that discipline and consistency would guide policy execution.

Economic analyst Mr Malone Gwadu told The Sunday Mail that the plan stood out for clearly sequencing reforms, particularly in currency management and institutional restructuring at the RBZ.

“This is a robust strategic plan that clearly articulates intended outcomes, especially around currency management and the restructuring of the central bank,” he said.

Mr Gwadu noted that several early gains had already been recorded, including improved exchange-rate stability, lower inflation and progress in building foreign reserves. He also highlighted the transfer of quasi-fiscal operations to Treasury as a critical step in easing pressure on the RBZ’s balance sheet.

“That process has de-stressed the central bank and re-oriented it towards supporting the five-year strategy,” he said. “Crucially, it provides a structured, market-driven pathway towards a mono-currency system by 2030.”

The strategy identifies sustained disinflation as the anchor of monetary policy. Inflation, which eased to about 15 percent in 2025, is projected to fall into single digits in 2026. The RBZ has indicated it will resist premature policy loosening, opting instead for data-driven decisions to keep inflation expectations firmly anchored.

“A tight monetary policy stance was necessary to tame inflation,” Dr Mushayavanhu said. “Going forward, disciplined money supply management will remain central, with flexibility to respond to emerging risks without undermining stability.”

Economist Ms Victoria Ncube said the renewed focus on cleaning up the RBZ’s balance sheet and strengthening governance frameworks was critical for restoring policy effectiveness.

“For a long time, monetary policy transmission was weakened by quasi-fiscal activities and balance sheet constraints,” she said. “Completing the restructuring strengthens the Bank’s independence and creates the policy space needed for credible signals to the market.”

Ms Ncube also welcomed plans to shift from direct controls to market-based monetary instruments, arguing that this would improve liquidity management and deepen financial markets. “The move towards inflation targeting, supported by improved data, forecasting tools and clearer communication, is a positive development,” she said, adding that consistency would be key to building lasting credibility.

The strategy outlines three Strategic Key Focus Areas, led by the consolidation of price, currency and exchange-rate stability to support the Zimbabwe Gold (ZiG). Measures include improving the quality and circulation of ZiG banknotes, deepening the foreign exchange market through the willing-buyer willing-seller system, and building reserves equivalent to three to six months of import cover by 2030.

From a banking perspective, Mr Raymond Madziwa said the commitment to moderating exchange-rate volatility and steadily accumulating reserves would be closely scrutinised by investors and financial institutions.

“Predictability is critical for planning,” he said. “The RBZ’s clear stance signals that currency stability is not a short-term intervention, but a sustained policy objective.”

He added that plans to modernise payment systems, strengthen Anti-Money Laundering and Counter-Financing of Terrorism (AML/CFT) frameworks, and adopt international supervisory standards such as Basel III would enhance financial sector resilience. The emphasis on financial inclusion, small and medium enterprises and digitalisation was also seen as aligning monetary policy with real economic activity.

Beyond core monetary reforms, the RBZ’s enabling focus areas include an ambitious digitalisation agenda, the establishment of a fintech innovation hub, exploration of a central bank digital currency, and stronger enterprise-wide risk management frameworks. The Bank has also published its first Stakeholder Service Charter, committing to improved transparency and accountability.

Analysts say the strength of the strategy lies not only in its scope, but in its recognition that stability must precede ambition. As reported by The Sunday Mail, the gradual disclosure of the roadmap has helped reassure the public, build market buy-in and support broader acceptance of the ZiG.

Ultimately, observers caution that the success of the plan will hinge on policy consistency, fiscal restraint and the RBZ’s ability to maintain credibility in a challenging global economic environment.