HARARE – The Reserve Bank of Zimbabwe (RBZ) has strongly defended its current monetary and exchange rate framework, dismissing some key recommendations from the International Monetary Fund (IMF) while maintaining confidence in the stability of the newly introduced Zimbabwe Gold (ZiG) currency.

In a press release issued this week, the IMF summarised the conclusions of its Article IV consultation with Zimbabwe, held on 27 August 2025. The Fund acknowledged the effectiveness of “tight monetary policy” in stabilising the ZiG and reducing inflation, but urged authorities to move swiftly towards a more transparent, market-based foreign exchange (FX) system and overhaul surrender requirements.

The RBZ, according to the State media, however, insisted its policies were already yielding results, underscoring a commitment to “price stability and policy reforms.” The central bank highlighted recent tightening of Non-Negotiable Certificates of Deposit (NNCDs) redemption rules as part of measures to maintain monetary discipline.

“Zimbabwe has adopted communication as part of its monetary policy toolkit and clarified the hierarchy of its policy objectives and targets in line with staff advice,” the RBZ said, pointing to stabilisation gains and lower inflation levels as proof of progress.

While IMF staff projected that a 50% annual growth in reserve money would align with the government’s 30% year-end inflation target, they raised concerns about the hybrid anchor model underpinning the ZiG. A composite basket of reserves fully backs the currency, but IMF analysts warned this could create confusion about the “nominal anchor,” a role traditionally served by a fixed exchange rate or inflation target.

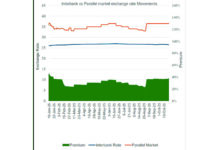

Further friction emerged over the foreign exchange system. The IMF argued that the willing-buyer willing-seller (WBWS) mechanism did not appear to respond to market dynamics and fell short of a floating arrangement. It recommended cutting back the RBZ’s influence in the FX market and redirecting the 30% export surrender requirement into the open market through authorised dealers.

In sharp contrast, the RBZ rejected suggestions that it dominated the WBWS market, maintaining that the system is “fully market-determined.” The central bank argued that removing or redirecting the surrender requirement would “reduce scope to stabilise the exchange rate and complicate efforts to build international reserves.”

Authorities said they were, however, willing to consider funnelling any “incremental surrender requirements” above 30% into the market and to gradually reduce interventions—once an efficient interbank trading platform is in place. To this end, the RBZ has formally requested IMF technical assistance to establish an interbank FX market.

Differences also emerged over monetary instruments. The IMF recommended phasing out NNCDs, describing them as “ineffective for policy transmission and market development.” Instead, it urged Zimbabwe to adopt tradable, interest-bearing securities and to relax rigid reserve requirements to improve liquidity management.

The RBZ said it was already planning a gradual transition away from direct controls, citing the introduction of multiple NNCD tenors, remunerated certificates, and a Term Deposit Facility to develop interest rates as an active policy tool.

On longer-term reforms, the central bank confirmed that the National Development Strategy 2 (NDS2) would outline the roadmap for managing USD and ZiG deposits and clarify the future of surrender requirements as Zimbabwe moves towards its goal of achieving a mono-currency system by 2030.

The IMF also flagged concerns over exchange rate restrictions, but the RBZ defended its framework, insisting that most restrictions served “desirable macroprudential purposes.” It added that recent FX guidelines had already removed de jure restrictions, with any remaining compliance issues stemming from “agents’ internal procedures.”

The authorities are further committed to strengthening financial oversight, including finalising the Basel III capital framework.

Market Reaction/Analyst View

Market watchers in Harare noted that while the IMF’s recommendations reflect a push for faster liberalisation, the RBZ’s cautious stance underlines the government’s priority of stability over speed. Analysts said the IMF’s emphasis on transparency and market-based reforms could reassure international investors, but sudden changes risk destabilising the still-fragile ZiG.

Independent economist Godfrey Kanyenze told The Zimbabwe Mail that “the RBZ’s defence of surrender requirements shows its focus on building reserves, but this also means exporters will continue to feel squeezed. The IMF is right on transparency, but Zimbabwe’s policymakers are worried about speculative shocks.”

Financial sector analysts added that the standoff may slow re-engagement with lenders and investors who typically rely on IMF assessments as a benchmark. However, some business leaders argued that the RBZ’s commitment to monetary discipline and its request for IMF technical assistance signalled a willingness to reform—albeit on its own terms.

For now, the debate underscores Zimbabwe’s tightrope walk: balancing IMF expectations with the political and economic realities of managing a new currency in a volatile environment.