Consumer goods prices are expected to further stabilise in 2026, anchored by manufacturers’ leveraging exchange rate stability, improved agricultural output and growing use of green energy to enhance cost efficiencies, according to Morgan & Company’s latest report.

The research firm noted in its Zimbabwe Consumer Goods Sector Report 2026 that the easing of inflationary forward-pricing, where producers pre-emptively hike prices in anticipation of exchange rate movement, has been one of the most notable developments since the liberalisation of the foreign exchange market in April 2025.

“The liberalisation of exchange rates in April 2025 by the central bank has resulted in reverse-engineered USD prices from formal manufacturers receding closer to informal market prices,” said Morgan & Company.

“The stability in exchange rates will prompt an ease in inflationary forward pricing.”

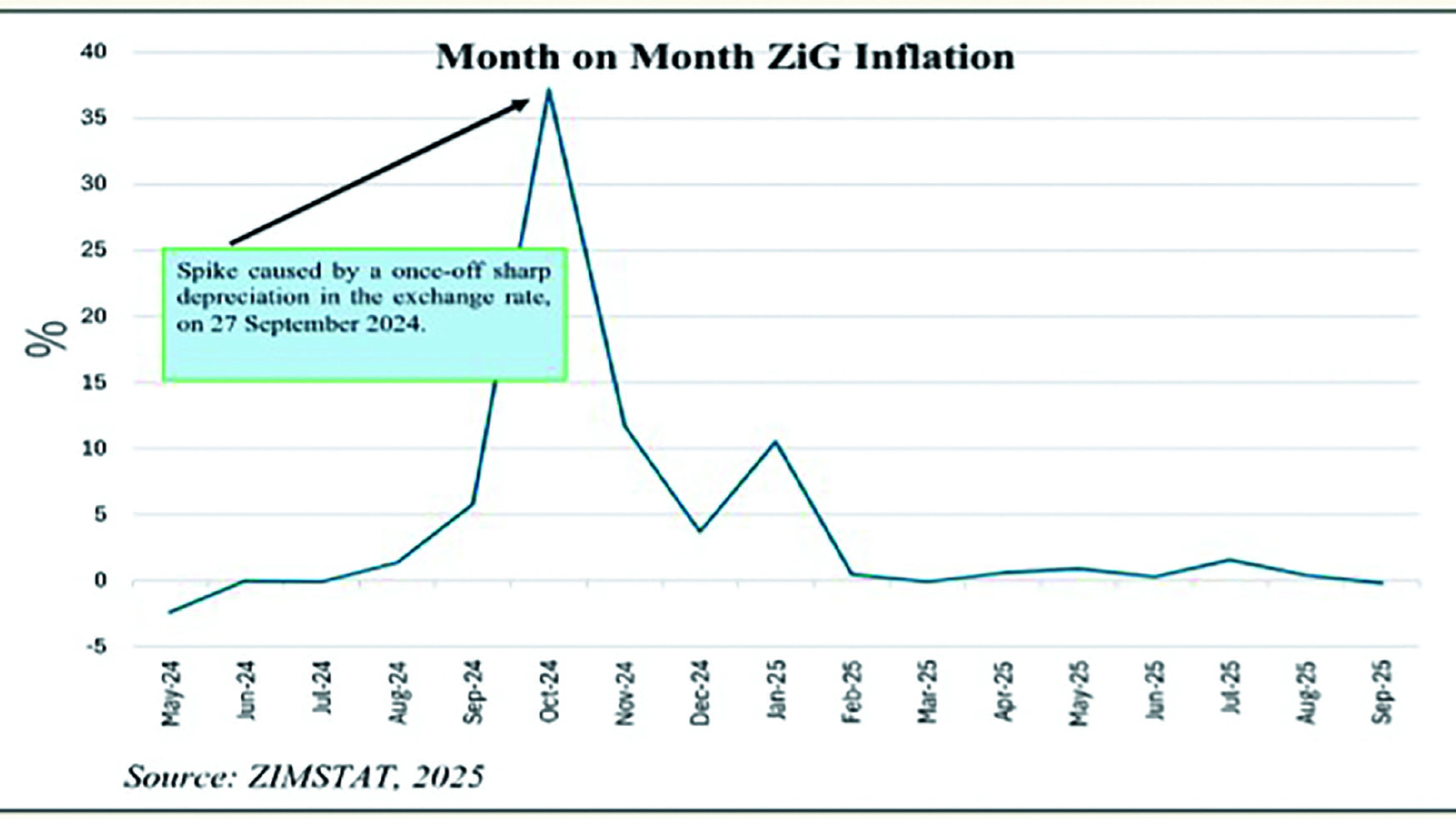

The research firm’s projection tallies with the picture from the central bank’s third quarter macroeconomic snapshot, which noted that monthly local currency inflation had averaged a lowly 0,6 percent since February, while the annual rate is forecast to close the year below 20 percent.

On account of the tight monetary policy thrust, the exchange rate has also stabilised, hovering around ZiG 26,7 to the US dollar.

Morgan and Company said prices of manufactured food and beverages were expected to soften in 2026 on account of continued exchange rate stability and lower input costs.

The moderation in inflationary pressures has been further reinforced by a price-sensitive consumer base, compelling producers to maintain affordability to preserve market share.

“Given a price-sensitive consumer goods market, manufacturers will leverage on these positives to enhance cost efficiencies in a bid to cushion the impact of taxes,” the report notes.

Economic analyst Yemurai Kadimu said the stabilisation in both formal and informal market prices was a reflection of growing market confidence.

“For once, manufacturers and consumers are operating in a predictable environment,” Ms Kadimu said. “This stability helps business planning, reduces speculative behaviour and ultimately lowers the inflationary psychology that had gripped the sector.”

She added that while macroeconomic stability had not been fully achieved, the narrowing gap between official and parallel market rates has significantly improved pricing transparency in the fast-moving consumer goods (FMCG) industry.

Morgan & Company projected that direct costs would ease as agricultural output continues to recover following favourable rains expected due to the La Niña phase.

“A La Niña phase underscored a rebound of the agriculture sector in the 2024/25 season, which has allayed any risks of raw materials supply in the food and beverages manufacturing process,” the firm observed.

According to the Crops, Livestock and Fisheries Report’s second-round estimates for 2025, maize and wheat production are expected to reach 1,8 million tonnes and 603 000 tonnes respectively, while sorghum output is forecast to climb to 288 344 tonnes by year-end.

Above-average rainfall is also expected during the 2025/26 agricultural season, sustaining the positive momentum in agricultural output.

Producer prices for several crops have already started to decline, providing manufacturers with cost relief. Lower stockfeed prices are also expected to support margins for producers of meat and milk-based goods in 2026.

Ms Kadimu noted that this was a rare opportunity for Zimbabwean manufacturers to rebuild working capital and reinvest in efficiency improvements.

“When raw material costs drop, it gives manufacturers breathing room to address other constraints such as machinery upgrades and product innovation,” she said. “It is an opportunity to enhance competitiveness both locally and regionally.”

On the energy front, the report indicates that electricity supply will improve in 2026 due to increased hydroelectric generation at Kariba and consistent output from Hwange Thermal Power Station.

The expected above-average rains from December 2025 to March 2026 are set to lift water levels at Kariba, thereby supporting greater hydro output.

“A weak La Nina phase will result in above-average rains in Zimbabwe between December 2025 and March 2026,” Morgan & Company said. “This is expected to support water levels at Kariba and, in turn, hydroelectric power output.”

The expansion of green energy initiatives, including solar installations by light manufacturers, is also expected to cushion production costs in the long term.

However, the report warns that fuel costs remain a challenge. The Government’s upward revision of the strategic reserve levy on fuel in May 2025, under Statutory Instrument 50 of 2025, has offset the benefits of declining global oil prices.

At present, the levy stands at US$0,247 per litre of petrol and US$0,187 per litre of diesel, up from US$0,177 and US$0,157, respectively, at the beginning of the year.

“The adjustments have been so significant that they have overshadowed the decline in global oil prices and will likely perpetuate margin pressures on manufacturers’ overheads,” said Morgan & Company.

Ms Kadimu added that while the Government’s decision was meant to bolster the strategic fuel reserve, this had the potential to erode some of the cost advantages gained from a stable exchange rate and falling input costs. – Herald