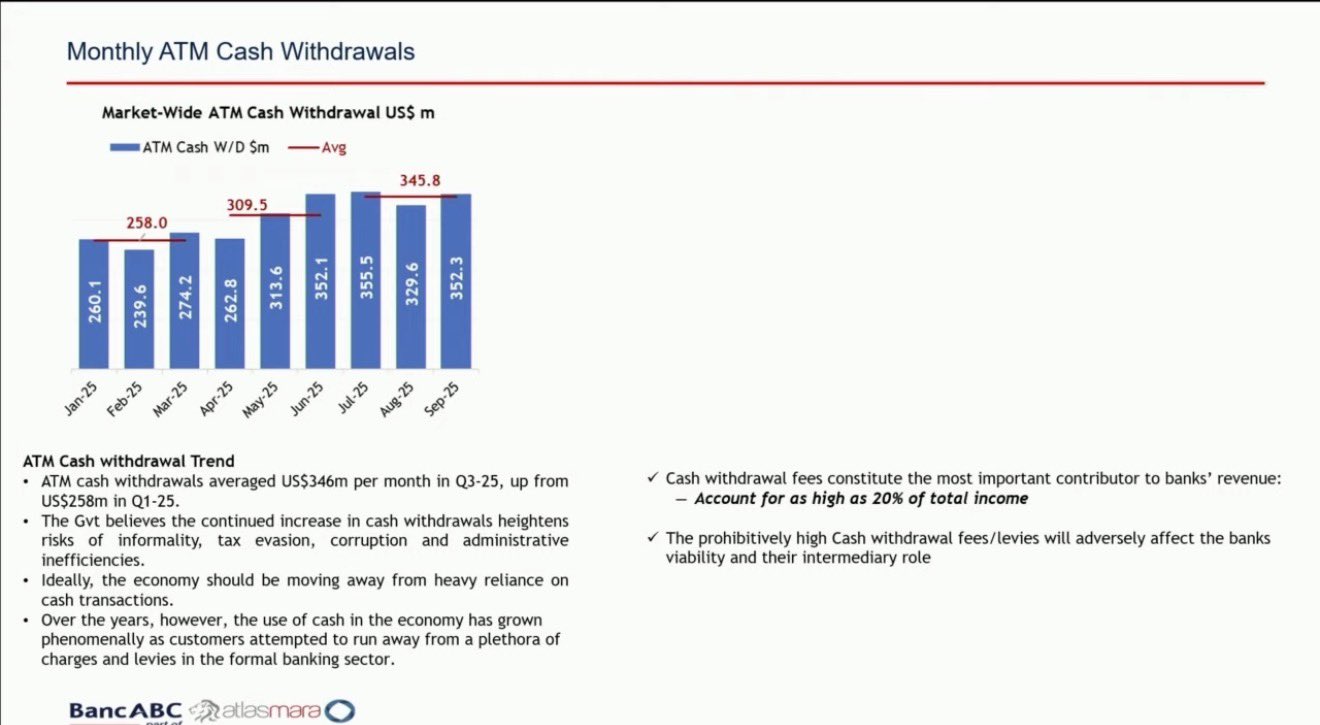

HARARE — Zimbabweans are now withdrawing an estimated US$346 million per month from automated teller machines (ATMs), a sharp rise from around US$260 million at the beginning of the year, according to sector figures shared by BancABC executive James Wadi.

The surge, according to NewZwire business and finance publication, reflects the population’s continued reliance on cash in an economy where informal transactions dominate and confidence in digital systems remains fragile.

However, Finance Minister Mthuli Ncube’s proposal to introduce a new tax on ATM withdrawals — announced as part of wider fiscal measures — is expected to make accessing cash more expensive. Analysts warn that the move could further discourage the public from using formal banking channels, potentially shrinking an already narrow deposit base.

Wadi cautioned that the proposed levy would “push more people out of the formal system and deepen informality,” arguing that banks may see reduced ATM activity as customers opt for alternative, untaxed methods of accessing or circulating money.

Economists say the withdrawal tax risks compounding existing challenges, including low confidence in the banking sector, high transaction fees, and persistent inflationary pressures. With cash still preferred for everyday purchases, especially in informal markets, additional costs may fuel a new wave of cash hoarding and off-bank financial practices.

Meanwhile, bankers warn that declining use of formal channels could undermine ongoing efforts to stabilise the financial sector, reduce money-laundering risks, and build a transparent digital payments ecosystem.

The Ministry of Finance is yet to clarify the final structure of the proposed tax, but consultations with the banking industry are expected to continue in the coming weeks.