HARARE — Zimbabwe’s telecommunications sector recorded steady growth in the third quarter of 2025, driven largely by rising data demand, satellite internet uptake and strong performance by fibre operators, according to the latest industry statistics released by the Postal and Telecommunications Regulatory Authority of Zimbabwe (POTRAZ).

Subscriber Growth Remains Broad-Based

Total active internet and data subscriptions increased from 12.83 million in Q2 2025 to 12.99 million in Q3 2025, representing a 1.27% quarterly growth. Mobile internet subscriptions remain the backbone of the sector, rising to 12.63 million, up 1.08%, reflecting the continued dominance of smartphones as Zimbabwe’s primary gateway to digital services.

Fixed LTE subscriptions recorded a notable 12.75% increase, while leased lines grew by 17.53%, pointing to sustained demand from corporates, government institutions and data-intensive enterprises. In contrast, legacy technologies such as DSL, WiMAX and CDMA continued their structural decline, underlining the sector’s transition toward fibre, LTE and satellite-based connectivity.

Starlink Accelerates VSAT Growth

VSAT subscriptions jumped sharply by 26.91%, rising from 40,146 to 50,949, largely driven by the rapid uptake of Starlink, which added an estimated 10,000 new subscribers during the quarter. Industry analysts say satellite broadband is increasingly filling coverage gaps in rural areas, mining operations and farming communities where terrestrial infrastructure remains limited.

This trend underscores a broader shift in Zimbabwe’s connectivity landscape, where satellite services are no longer niche but are becoming a meaningful competitor to traditional fixed networks.

Fixed Data Traffic Surges Nearly 19%

Fixed internet and data traffic grew by a robust 18.39%, from 372.4 million GB in Q2 to 440.9 million GB in Q3, highlighting the accelerating consumption of data by households, businesses and institutions.

Liquid Telecom maintained its market leadership, accounting for 58.9% of fixed data traffic, with usage rising 11.69% quarter-on-quarter. However, the most striking growth came from African Fibre Networks (AFN), formerly Dark Fibre Africa, which recorded an extraordinary 443.37% increase in data traffic, jumping from 1.43 petabytes to 7.74 petabytes. While still a relatively small player by market share, AFN’s surge signals aggressive network rollout and rising demand for wholesale fibre capacity.

Starlink also posted strong momentum, with fixed data traffic growing 40.37%, giving it a 26.73% market share, firmly positioning it as the second-largest fixed data provider in Zimbabwe.

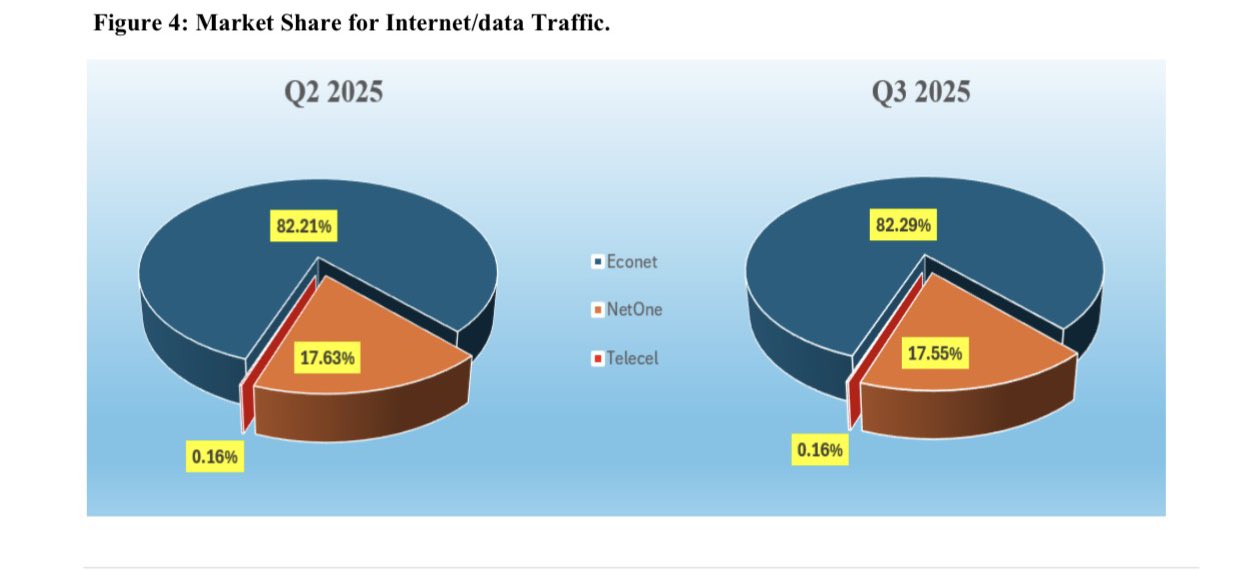

Econet’s Continued Dominance

On the mobile side, Econet Wireless Zimbabwe remains the dominant force in the sector. POTRAZ data shows Econet controls approximately 73% of mobile subscribers, 87% of voice traffic, 82% of mobile data usage, and the largest share of national telecoms infrastructure. This scale advantage continues to translate into market leadership despite intensifying competition in data services.

Data Now the Core Revenue Driver

The latest figures confirm a structural shift in telecoms revenues. Data services now account for 49% of mobile operators’ revenues, overtaking traditional voice services, which contribute 36%, with the remainder coming from SMS and other value-added services. This transition reflects changing consumer behaviour, driven by social media, video streaming, mobile banking, e-commerce and cloud-based applications.

Outlook: Infrastructure, Competition and Policy

The Q3 results point to a sector undergoing rapid transformation. Growth is increasingly driven by data-intensive services, fibre infrastructure, and satellite connectivity, while older technologies continue to fade. Analysts expect competition to intensify further as new fibre players scale up and satellite broadband expands its footprint.

However, challenges remain. High data costs, foreign currency exposure, power supply constraints and infrastructure duplication continue to weigh on the sector. Policymakers are also under pressure to update regulatory frameworks to reflect the rise of non-traditional players such as Starlink and wholesale fibre operators.

Overall, POTRAZ’s third-quarter data paints a picture of a telecoms industry that is growing, modernising and becoming more data-centric — a critical enabler for Zimbabwe’s digital economy, but one that will require sustained investment, smart regulation and competitive discipline to unlock its full potential.